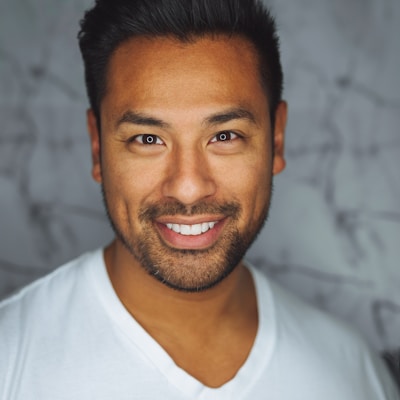

“Working with Peter and Daniel at Madison Street Capital was an exceptional experience. Their expertise and dedication were instrumental in the successful sale of Executive Landscaping, Inc. to Fairwood Brands.”

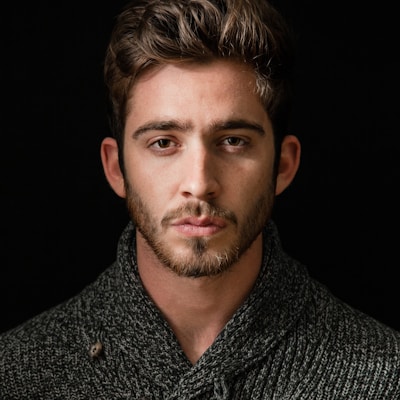

Chris Cotoia

Owner and CEO, Executive Landscaping